I was stunned when I received my latest car insurance bill. Despite no claims or changes, my premium jumped yet again—this time by double digits.

I hadn’t gotten a new car, my record was clean, and I drive less than before. But every year, I watched my payments climb and assumed it was just the norm for everyone these days.

It wasn’t until this last increase that I finally decided to see if there was something better out there.

Turns out, there was—and the solution was surprisingly fast and painless.Click your state to get a free quote.

For years, I believed sticking with the same insurer meant I’d be rewarded, but auto insurance works on a totally different set of rules.

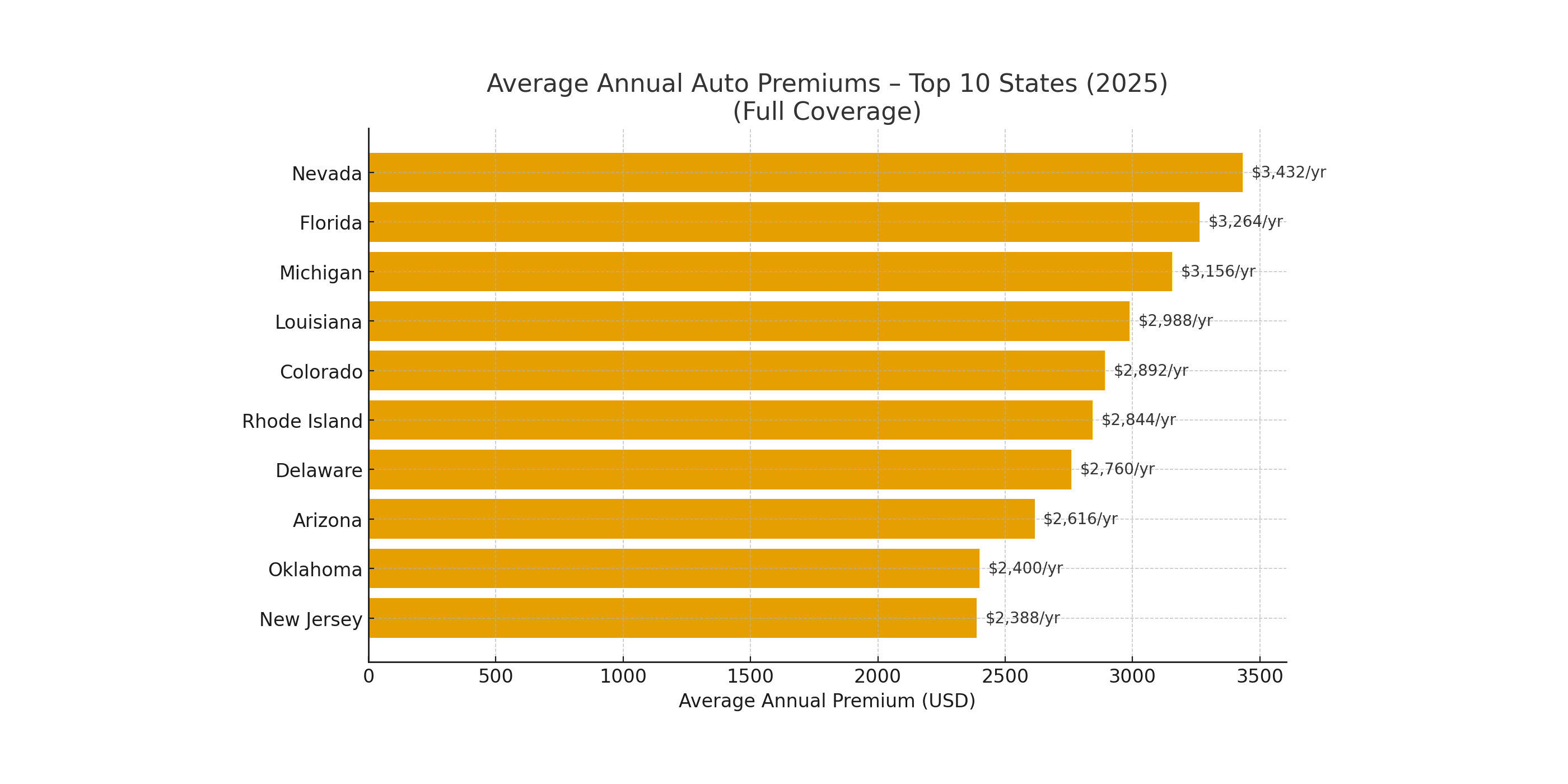

Carriers all have their own formulas—factors like your ZIP code, driving patterns, car details, and even your insurance history can all affect what you pay. For instance, my home state, Florida, tends to have the highest rates nationwide thanks to frequent storms and lots of uninsured motorists.

Your neighbor could be paying hundreds less (or more) for virtually the same coverage, just because their details hit differently in each company’s system. The only way to make sure you’re not missing out is to shop for quotes from other insurers regularly.

2025 full coverage auto insurance averages by state.

I used to dread comparing plans, expecting a long, frustrating process. Instead, using a reputable online site to request multiple quotes took virtually no effort. In minutes, I could see detailed offers and saved a significant amount overall.

All I had to do was answer a few questions about my car and myself. Suddenly, I had real prices from trusted insurance companies in front of me.

Sample quotes laid out:

Comparing these side-by-side made my choice clear in seconds.

For a long time, I put off looking for a better deal because it sounded tedious. But it couldn’t have been simpler—and the price drop was real. All it really takes is a few clicks to see options you might never have considered.

If your current bill surprises you—or you haven’t checked your rate in over a year—don’t wait for renewal to start saving.

, and discover what you could be keeping in your wallet.